The ledger of mai company includes the following accounts – The ledger of Mai Company serves as a central repository for recording and maintaining financial transactions, providing a comprehensive view of the company’s financial health. This article delves into the various accounts included in the ledger, their significance, and their impact on business decision-making.

The ledger categorizes accounts into distinct types, each serving a specific purpose. These include asset accounts, liability accounts, equity accounts, revenue accounts, and expense accounts. Understanding the nature and function of these accounts is crucial for accurate financial reporting and effective financial management.

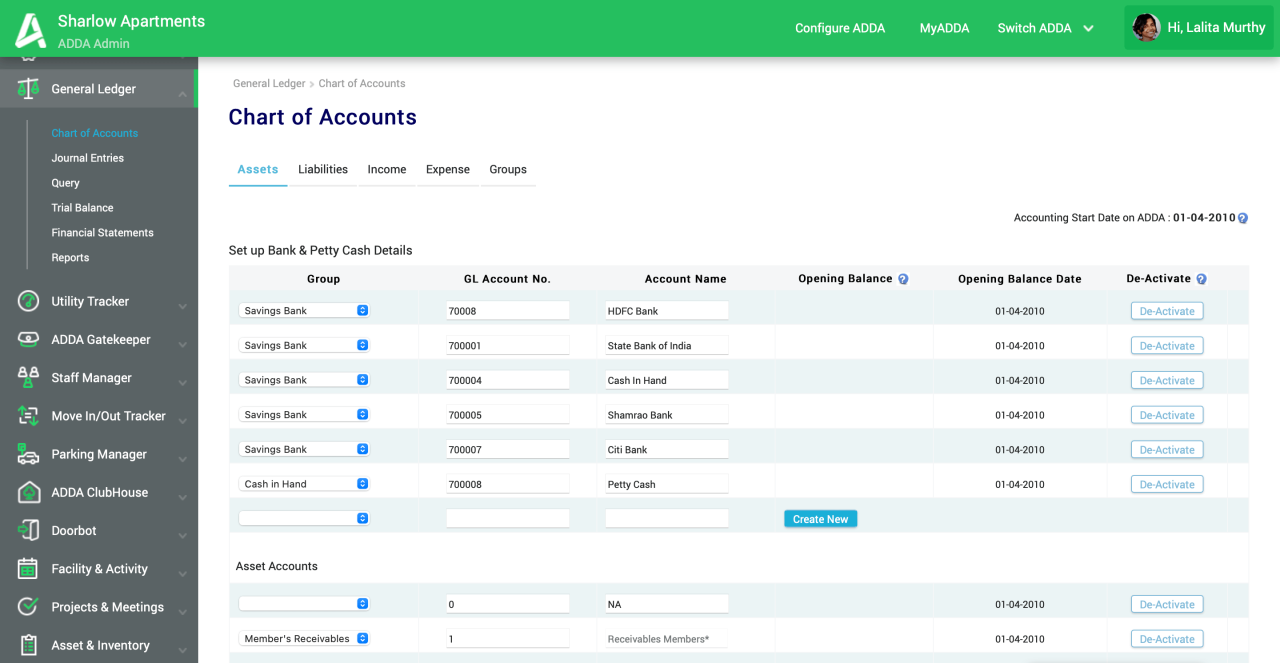

Assets Accounts

Asset accounts represent the resources owned by a company that have monetary value and can be converted into cash or used to generate income. They are classified into various categories, including:

Current Assets

- Cash and cash equivalents: Readily available funds, such as cash on hand, bank accounts, and short-term investments.

- Accounts receivable: Amounts owed to the company by customers for goods or services sold on credit.

- Inventory: Goods or materials held for sale or use in production.

- Prepaid expenses: Expenses paid in advance, such as insurance premiums or rent.

Non-Current Assets

- Property, plant, and equipment: Tangible assets used in the company’s operations, such as buildings, machinery, and vehicles.

- Intangible assets: Assets that lack physical form but have economic value, such as patents, trademarks, and copyrights.

- Investments: Long-term investments in other companies or financial instruments.

Importance of Asset Accounts

Accurate recording and maintenance of asset accounts are crucial for several reasons:

- Tracking the company’s financial position and resources.

- Monitoring the efficiency of asset utilization.

- Making informed decisions regarding asset acquisition, disposal, and financing.

Liability Accounts

Liability accounts represent the obligations of a company to others. They are classified into various types, including:

Current Liabilities

- Accounts payable: Amounts owed to suppliers or creditors for goods or services purchased on credit.

- Short-term loans: Loans with a maturity of less than one year.

- Accrued expenses: Expenses incurred but not yet paid, such as salaries payable or interest payable.

- Unearned revenue: Revenue received in advance for goods or services not yet provided.

Non-Current Liabilities

- Long-term loans: Loans with a maturity of more than one year.

- Bonds payable: Long-term debt instruments issued by the company.

- Deferred revenue: Revenue earned but not yet recognized, such as prepaid subscriptions or magazine subscriptions.

Importance of Liability Accounts, The ledger of mai company includes the following accounts

Proper management of liability accounts is essential for:

- Tracking the company’s financial obligations.

- Ensuring compliance with loan covenants and other financial agreements.

- Maintaining a positive credit rating and reputation.

Equity Accounts

Equity accounts represent the ownership interest in a company. They are classified into:

Share Capital

- Common stock: Equity shares issued to the general public.

- Preferred stock: Equity shares with specific rights and preferences.

Retained Earnings

Accumulated profits of the company that are not distributed to shareholders as dividends.

Importance of Equity Accounts

Tracking and analyzing equity accounts is important for:

- Determining the company’s financial health and stability.

- Making decisions regarding dividend payments and stock repurchases.

- Attracting investors and maintaining shareholder confidence.

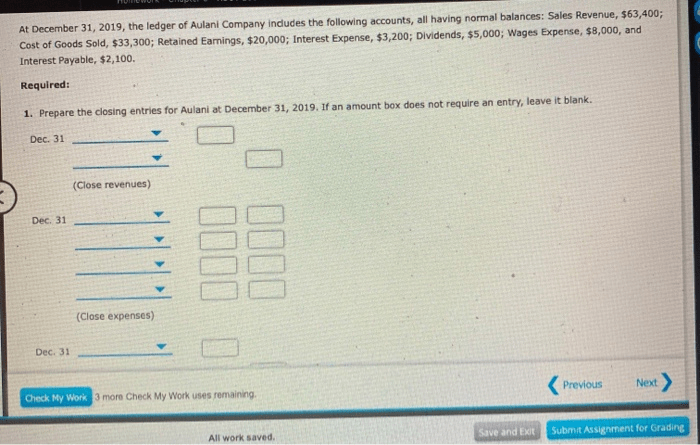

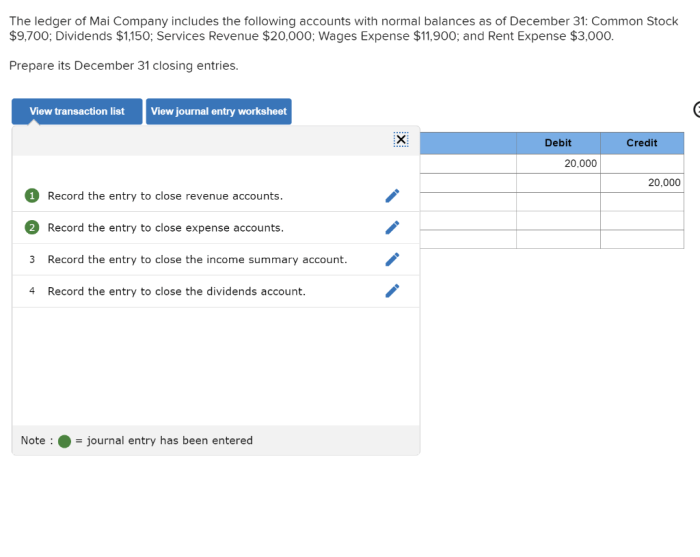

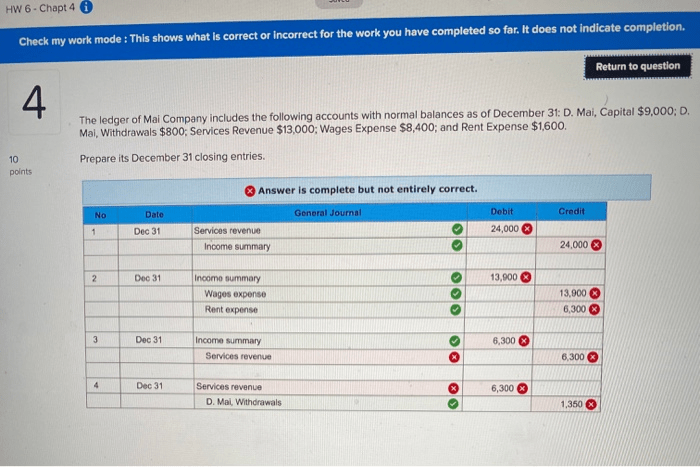

Revenue and Expense Accounts

Revenue accounts represent the income earned by a company, while expense accounts represent the costs incurred in generating that income. Common types include:

Revenue Accounts

- Sales revenue: Revenue from the sale of goods or services.

- Interest revenue: Income earned on investments.

- Rent revenue: Income earned from renting out property.

Expense Accounts

- Cost of goods sold: Direct costs of producing or acquiring goods sold.

- Salaries and wages: Compensation paid to employees.

- Rent expense: Rent paid for business premises.

- Depreciation expense: Allocation of the cost of fixed assets over their useful life.

Importance of Revenue and Expense Accounts

Accurate classification and recording of revenue and expense transactions are essential for:

- Measuring the company’s financial performance.

- Determining the profitability of operations.

- Making informed decisions regarding pricing, cost control, and resource allocation.

Financial Reporting

The ledger is used to generate financial reports, which provide a summary of a company’s financial performance and position. Common types include:

Balance Sheet

A snapshot of the company’s financial position at a specific point in time, showing its assets, liabilities, and equity.

Income Statement

A report of the company’s financial performance over a specific period, showing its revenues, expenses, and net income.

Cash Flow Statement

A report of the company’s cash inflows and outflows over a specific period.

Importance of Financial Reporting

Financial reports are used by various stakeholders for:

- Assessing the company’s financial health and performance.

- Making investment decisions.

- Evaluating the company’s creditworthiness.

- Complying with regulatory requirements.

Questions and Answers: The Ledger Of Mai Company Includes The Following Accounts

What is the purpose of an asset account?

Asset accounts record the value of resources owned by the company, such as cash, inventory, and equipment.

Why is it important to accurately record liability accounts?

Accurate recording of liability accounts ensures that the company’s financial obligations are properly reflected, allowing for informed decision-making regarding debt management.

What is the role of equity accounts in financial reporting?

Equity accounts represent the ownership interest in the company and provide insights into the distribution of profits and losses among shareholders.